Table Of Content

Households with a White, non-Hispanic householder had 10 times more wealth than those with a Black householder in 2021, according to the U.S. Whether or not you have to file an Oklahoma income tax return depends on your income and residency status. The credit is equal to 20% of the credit for childcare expenses allowed by the Internal Revenue Code (IRC) or 5% of the child tax credit allowed by the IRC, whichever is greater. On your state return, your total amount of deductions must be limited to $17,000. The only exceptions are charitable contributions and medical expenses, which aren’t subject to the $17,000 limit.

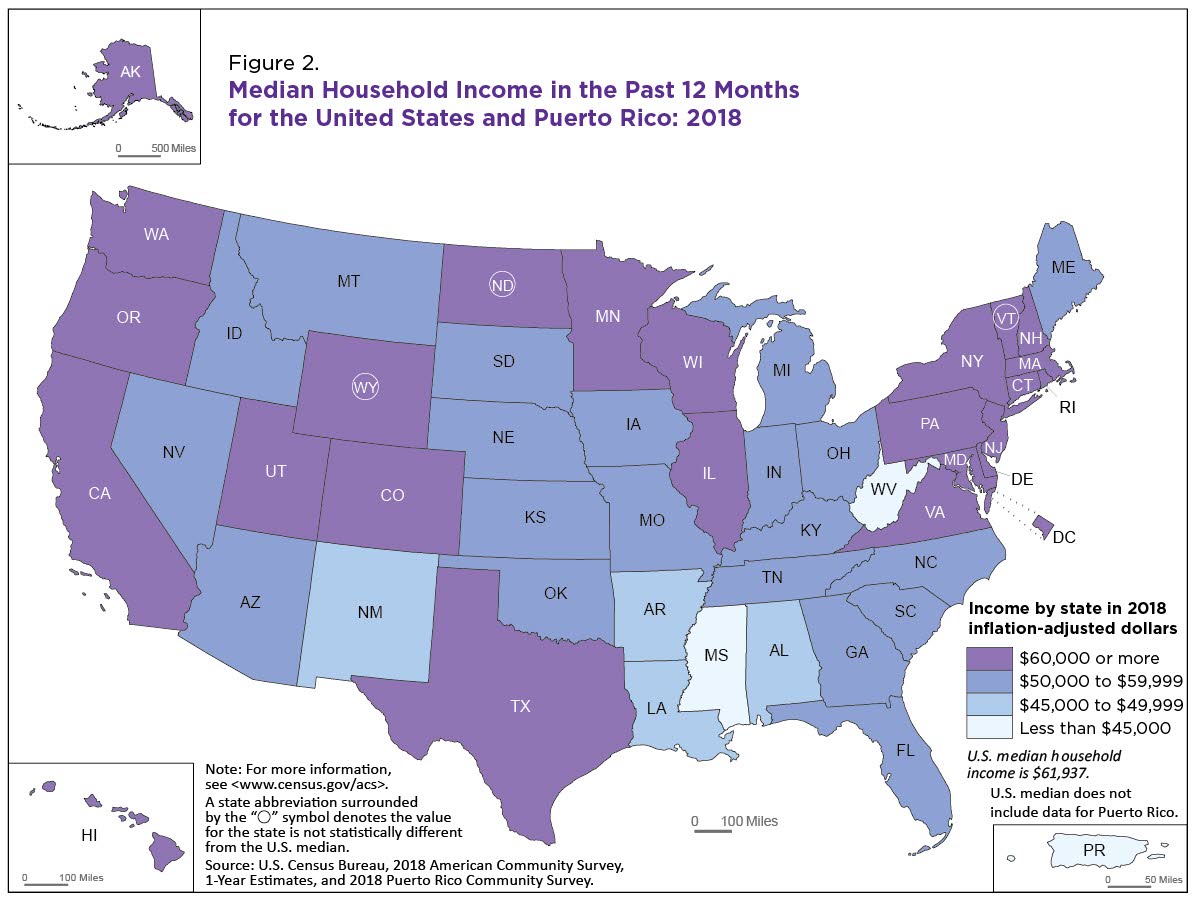

Median household income by U.S. territory

The per capita gross domestic product (GDP) of a country should typically increase along with the median household income. In recent years, a divergence has been seen between these figures in the United States. In turn, this has led to discussions about referencing median household income as a better indicator of economic well-being than GDP. Oklahoma offers tax deductions and credits to reduce your tax liability, including deductions for disability-related expenses and qualified adoption expenses, as well as a tax credit for income tax paid to another state.

Income Tax Deductions for Oklahoma

This percentage has remained relatively stable over time, although it decreased slightly in the first quarter of 2024. By contrast, the forward-looking indicator of late payment risk, measured as the proportion of households expecting to make a late payment in the next three months, has risen substantially among lower-income households. In the first quarter of 2024, the proportion of households expecting to make late payments for utilities or rent rose to over 20%, up from about 15% in 2023, and nearly doubled to 30% for late mortgage payments.

RESEARCH Household Pulse: Balances through October 2023 - JPMorgan Chase

RESEARCH Household Pulse: Balances through October 2023.

Posted: Thu, 25 Jan 2024 10:06:04 GMT [source]

RELATED DATA AND CONTENT

Black households had the lowest median income in 2021, at $48,297, a 0.3 percent increase from 2020. While the overall median income trended upwards year-over-year, several states faced a decrease in median household income. The largest decreases were in West Virginia (-9.88 percent) and Rhode Island (-6.48 percent). Meanwhile, the states with the largest increase in median income were Idaho (15.28 percent), Montana (14.55 percent) and Oklahoma (14.53 percent).

Figures

The Average American's Household Expenses Are $6,081 A Month Or $72,967 A Year — But The Median Annual ... - Yahoo Finance

The Average American's Household Expenses Are $6,081 A Month Or $72,967 A Year — But The Median Annual ....

Posted: Mon, 29 Jan 2024 08:00:00 GMT [source]

In 2020 and 2021, most households also received Economic Impact Payments (EIP) that were no longer issued in 2022. You cannot file as head of household if you are a nonresident at any time during the tax year. Generally, you cannot file as married filing jointly if either spouse was a nonresident of the U.S. at any time during the tax year. However, nonresidents married to U.S. citizens or residents can choose to be treated as U.S. residents and file joint returns. Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. To live comfortably in Massachusetts, a family of two working adults and two kids would need to earn $301,184 annually.

Itemized Deductions

There were 11.1 million more full-time, year-round workers in 2021 than in 2020, following the relaxing of COVID-19 restrictions. The national median household income is $74,580, according to the most recent U.S. Assistance from nonprofits and private sources—including financial support from a friend of family member living outside of their home—also played a role. Sixteen percent of adults ages 21 and older received at least one type of assistance from private or nonprofit sources in 2020 (table 4). Nearly 1 in 10 adults received financial assistance from a friend or family member living outside of their home, essentially unchanged from 2019. More than 1 in 10 adults received groceries or meals from a food pantry, religious organization, or community organization in 2020.

Oklahoma Income Tax Calculator 2023-2024

Among adults with less than a high school degree, this pattern is reversed, as 6 percent said their usual account balance increased, whereas 25 percent said it declined. By contrast, those with more education were the most likely to have reduced their total monthly spending. Fewer than 2 in 10 adults with a high school degree or less had lower monthly spending compared to a year ago. However, 27 percent of adults with at least a bachelor's degree decreased their spending.

Household size

This exceeded the 17 percent of those with at least a bachelor's degree who experienced an income decline. Among adults who experienced a layoff during the previous year, nearly one-half also saw their total monthly income decline relative to a year earlier. Regionally, in 2010, the Northeast reached a median income of $53,283, the West, $53,142, the South, $45,492, and the Midwest, $48,445.[52] Each figure represents a decline from the previous year. The early-2000s recession began with the bursting of the dot-com bubble and affected most advanced economies including the European Union, Japan and the United States. An economic recession will normally cause household incomes to decrease, often by as much as 10%. Real median household income generally rises over time — from 1984 to 2013, it rose by about $9,000, before increasing sharply from 2014 ($64,900) to 2019 ($78,250).

What is the median household income in the US?

For instance, households with a lower income are more likely to default than those with higher earnings. There were no statistically significant differences in the median amount of medical, student loan and credit card debt. But households with a White householder had more other unsecured debt than those with a Black householder (median amount $6,000 vs. $3,500). Wealthier households are more likely to hold income-generating assets like stocks and mutual funds or real estate outside of a primary home.

The share of adults who live in lower-income households ranges from 16% in Ogden-Clearfield to 49% in Las Cruces. The estimated share living in upper-income households is greatest in San Jose-Sunnyvale-Santa Clara, California (34%) and the smallest in El Centro, California (7%). U.S. workers with a bachelor’s degree or higher earned more than twice the income of those with only a high school education, according to Census Bureau data. Those with a college degree earned a median income of $115,456 in 2021, about 129 percent more than the $50,401 median income of those with only a high school diploma. White households earned a median income of $74,262, down 1 percent from 2020.

In 2021, 9.6 million people were kept out of poverty due to refundable tax credits. This number declined to 6.4 million in 2022 as the pandemic era expansions expired. The effect declined for each of the major age groups, with 3.5 million children lifted out of poverty in 2022 compared to 4.9 million in 2021.

Federal and state policy makers, as well as community planners often use statistics on median household income as indicators of current economic conditions within communities. Median household income estimates are frequently used to identify communities and the number of households eligible for various government programs. Black and Hispanic households have historically been economically disadvantaged, due to a number of factors, including redlining and hiring discrimination. A Bankrate study from February 2022 also found that checking account fees hit Black and Hispanic households the hardest. Black households had the lowest and Hispanic households the second lowest median incomes in 2021.

Households with a White householder were more likely than households with a Black householder to own all asset types measured by the SIPP (Figure 2). Those with a Black householder made up 13.6% of all U.S. households but held only 4.7% of all wealth. And their median wealth ($24,520) was about one-tenth the median wealth of households with a White householder ($250,400).

Housing costs take up around 20% of disposable income for outright owners, 40% for renters and 35% for mortgagors. Nevertheless, this differs across income groups, with the housing cost ratio having increased slightly for the top 20% of earners among mortgage and renter households, but remaining fairly stable for the bottom 50% of earners. More households, and in particular lower-income households, have indicated in recent months that they expect to make late payments of their rent or mortgage and/or their utilities. In recent years, some 5-10% of low-income households have stated that they have made a late payment of rent or a mortgage and/or utilities in the past three months (Chart D, panel a).

Chart C plots the proportions of overburdened households for the eleven euro area countries covered by the Consumer Expectations Survey, broken down by income quintile and ownership type. In the lowest income quintile more than 60% of households are overburdened, and in particular renter households. Although the proportion of overburdened households in the higher income quintiles is substantially lower, it nevertheless encompasses about 45% of households in the second income quintile and over 20% of those in the third quintile. “Overburdened” households with a higher income are mostly mortgagors who face difficulties in paying their mortgage costs. Interestingly, the share of overburdened households in the fourth income quintile is higher than in the third, driven by mortgagors. This may reflect the fact that, in the low interest rate environment of the past, such households took out disproportionately more mortgage debt relative to their incomes.

It did so by asking those who reported varying income whether they struggled to pay bills as a result. More than one-third (37 percent) of those who experienced income volatility, representing slightly more than 1 in 10 adults overall, said they struggled to pay their bills at least once in the past 12 months due to varying income. Individuals with less education also were more likely to say they spent more than their income.

No comments:

Post a Comment